CREDIT ACADEMY

The Kredit Koncepts Credit Academy’s “Credit Education Program” (C.E.P.) will educate students about personal credit, identity theft, budgeting, and personal finance. The program will educate students on how to capture the power of positive credit and avoid the pitfalls of credit neglect.

C.E.P. courses will be offered to middle and high school students as part of a curriculum for the academic year. Credit experts lead all courses. Once a student completes the program, they will be awarded a Credit Course Certificate of Completion.

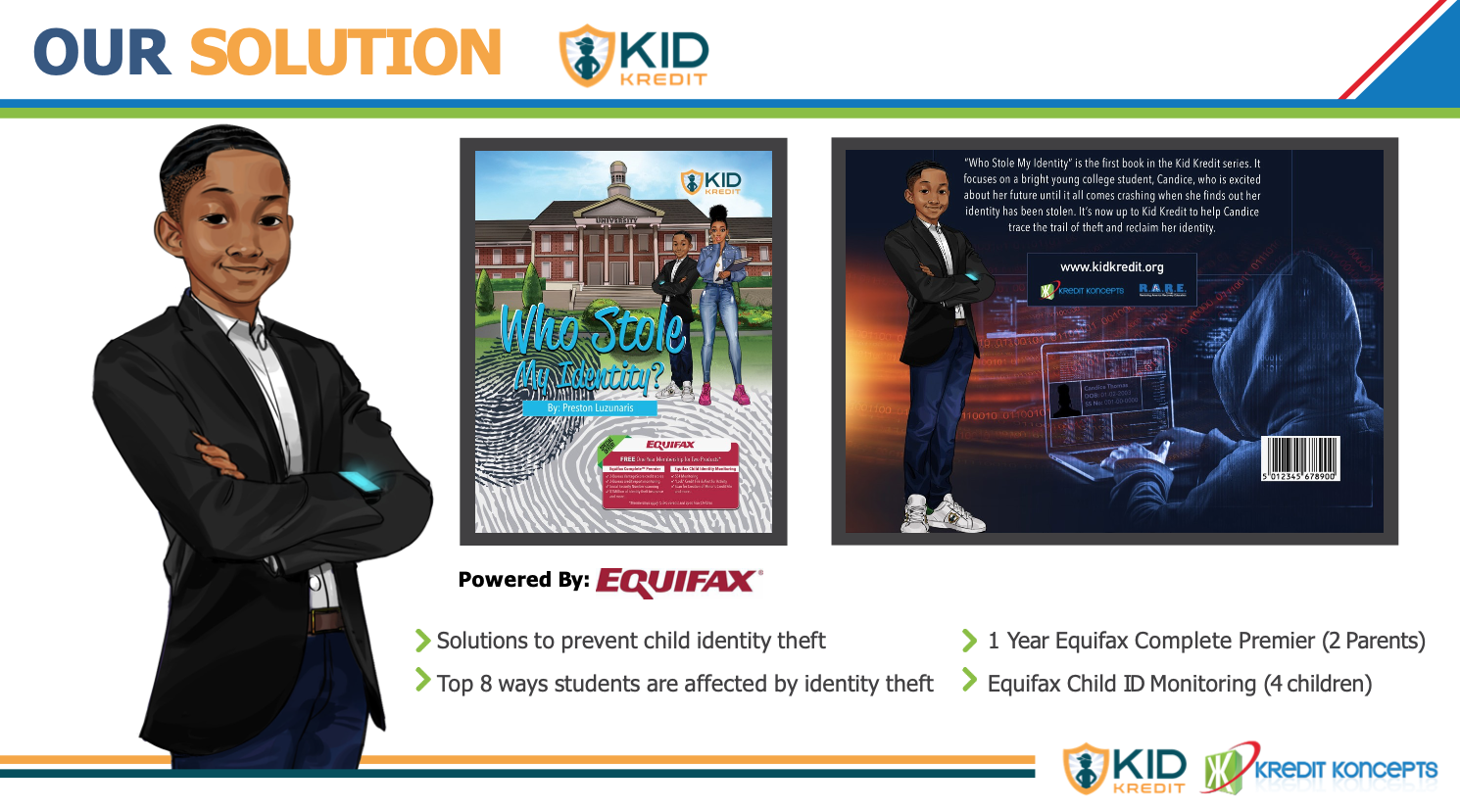

One highlight of the pilot program is the integration with the Kid Kredit platform. Kid Kredit Inc., a New York based Credit Protection Firm backed by a 15 year CEO named Preston K. Luzunaris aka “Kid Kredit”. Kid Kredit provides a step by step book titled “Who Stole My Identity?” and access to a premium “Money Management Software”, which helps them learn the value of work and financial responsibility.

Schools that have an interest in the Credit Academy Education program, may contact us at support@kreditkoncepts.com.

WHO WE ARE?

2007 Started Kredit Koncepts a Financial Literacy & Credit Education Firm providing Credit Recovery, Credit Building

2015 Launched community Credit Education Centers in underserved communities.

2016 Partnered with Equifax #1 Credit Bureau to offer exclusive Credit Protection Membership. Published 3D illustration book (Who Stole My Identity?) that offers FREE Equifax Identity Theft Protection Memberships.

2019 Launched the KK Credit Academy, a 12-course Interactive Curriculum with Progress Reports, Chapter Quizzes & Credit Certifications.

2021 Partnered with BUSYKID & Visa to provide students with real life lessons in managing money with App & Visa® Spend Card.

2022 Established New York City Dept. Of Education Vendor ID (#KRE165414)

OUR COURSE OUTLINE COVERS THE 12 KEY AREAS OUTLINED IN THE NEW YORK SENATE BILL S5827B FOR FINANCIAL LITERACY EDUCATION

Week 1-6

ID THEFT

- What is identity theft

- How Does ID theft happen

- Ways to protect yourself

- Types of Identity thef

BUDGETING

- What is a budget

- Budgeting strategies

- Budgeting for your home

- Budgeting for transportation

- Budgeting for food

CREDIT EDUCATION

- Types of credit

- Managing credit

- Selecting a credit Card

- Credit History & Reports

- Breakdown of Credit Scores

Week 7-15

TAXES

- U.S tax system and forms

- Do I need to file a tax return

- Filing a Tax Return

FINANCE

- The Checking Account

- Choosing A Checking Account

- Online & Mobile Banking

- Why and How do we Save

- Choosing a Savings Account

STUDENT LOANS

- Paying for college

- Types Of student loans

- Pros & cons of student loans

Week 16-22

MANAGEMENT

- Economical decision making

- Building an emergency fund

- Repaying loans

- Paying down debt

CRYPTO & NFT’s

- What Is Cryptocurrency

- How Crypto Works

- What Is an NFT

- What Is Cryptocurrency Used for

- Pros and Cons of Crypto

AUTO/HOME

- Financing vs Leasing

- Step by step guide to homeownership

Week 23-29

INVESTING

- Why invest

- What are stocks and bonds

- Managing risks

- How to invest for retirement

CAREER

- Choosing a Career

- Workplace skills

- Finding a job

- Resumes & cover letters

- Interviewing for a job

- Starting a new job

INSURANCE

- Insurance Fundamentals

- Finding a Health insurance plan

- Home & Renters Insurance

- Life Insurance